We’re prone to biases, investors, businesspeople and individuals are also predisposed to cognitive and emotional factors that influence investment decisions.

What Is Trading Psychology?

A trader’s attitude and emotion are the result of his business psychology. All of these factors affect commercial decisions, and traders who can manipulate them are well placed to profit from trading psychology. Trading psychology is divided into two attitudes and four emotions.

Attitudes

- Discipline

- Risk aversion or risk acceptance

Emotions

- Greed

- Fear

- Hope

- Regret

Common Trading Psychology Mistakes

It’s a terrible thing to waste one’s mind. In spite of that, some investors are not able to handle the psychology of trading and thus make a great deal of errors in their investing.

1. Emotional Trading Decisions

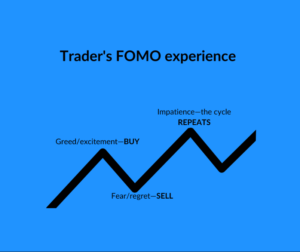

Careful analysis and not emotional impulses should be at the heart of effective investment strategies. However, decisions are being made according to emotional triggers by a large number of traders. Fear of Missing Out (FOMO) isn’t just a problem for teenagers; even investors sometimes fall prey to the herd mentality and make decisions based on this fear. Instead of a careful strategy, blindly following the masses can leave traders with bad decisions such as buying stocks that have already risen.

2. Overtrading

The trap of excessive trading can befall individual traders and brokers. For both parties, buying and selling excess stock can be dangerous. Brokers can attract the ire of the Securities and Exchange Commission (SEC) because overtrading in a customer’s account to generate commissions falls under the definition of manipulative and deceptive conduct. Individual traders who indulge in overtrading on their own account may not draw censure, but this scattershot approach rarely pays any dividends over the long run.

- Revenge Trading

Revenge trading is a scenario in which an investor seeks to recover losses by increasing the risk they take on their trades, similar to overtrading. The trader’s risk management perception could change if he suffered a serious loss, which would trigger the opening of new positions without any overarching strategy.

How to Improve Trading Psychology

1. Practice Self-Awareness

Reflecting on your trading decisions leads to self-awareness. For signs of overtrading, revenge trade or emotion trading decisions, traders should monitor their market behavior on a regular basis. How have your real trades compared with the strategy you had in mind before this month?

2. Stick to Your Goals

A business plan is needed by every trader. Their general strategy should be set out in the plan, with important details such as a desired risk reward ratio for trades being included. It will help to develop a strategy that has sound trading psychology if we can create a business plan free from emotional biases..

3. Maintain Discipline

Controlling your emotions and remaining disciplined despite external factors signifies a strong trading mindset. Don’t miss out on the limit set in your trading plan, and don’t let market fluctuations force you to buy or sell before you are ready.

4. Enforce Risk Management

Being a daredevil when it comes to trading can backfire. The option of adopting an approach with a strong policy for risk management is safer and more reliable. In order to reduce your losses as little as possible, set limits on the number of positions and use stop loss orders. You may be able to refine your trader psychology if you do not need to worry about threats that will come from within yourself.

The Importance of Trading Psychology

The importance of trading psychology has been recognized by successful investors. If traders can master the psychology of market trading, they will be able to avoid some of the risks in stock markets. Discipline and focus can help you achieve your desired result in the stock market, so it is of utmost importance to develop a positive mind set while being a trader.